New 2020 T4 Reporting Requirements

For the 2020 tax year, CRA has introduced four new codes to the “Other Information” section of the T4 Slip. These additional reporting requirements will apply to all employers, and are intended to assist CRA to validate payments under the Canada Emergency Wage Subsidy (CEWS), the Canada Emergency Response Benefit (CERB) and the Canada Emergency Student Benefit (CESB).

In addition to reporting employment income in Box 14 of the T4 Slip, all employers that paid employment income to employees on a pay date that fell between March 15 and September 26, 2020 are required to use the new other information codes to report employment income and retroactive payments in the following periods:

Code 57: Employment income – March 15 to May 9

Code 58: Employment income – May 10 to July 4

Code 59: Employment income – July 5 to August 29

Code 60: Employment income – August 30 to September 26.

Note that the above periods refer to the date the employee was paid and not to the period in respect of which the work was performed. For example, for employment income earned during the period from June 21 to July 4, 2020, payable on July 6, 2020, the information would be reported under Code 59.

The amount reported in each period should include all income received, both cash payments and non-cash taxable benefits.

For more details on preparing and filing T4 Slips for the 2020 tax year, please refer to CRA’s Employer’s Guide – Filing the T4 Slip and Summary.

Temporary Adjustments to the Automobile Standby Charge for the 2020 and 2021 Taxation Years Due to COVID-19

The automobile standby charge reflects the taxable benefit to an employee for the personal use of an employer-provided automobile. The annual general standby charge calculation is as follows:

2% of the purchase cost of the vehicle (including taxes) multiplied by the number of 30-day periods the vehicle is available to the employee;

OR

2/3 x the monthly lease cost (including taxes) multiplied by the number of 30-day periods the vehicle is available to the employee

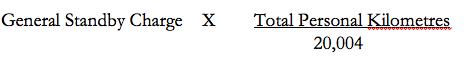

The standby charge may be reduced where the automobile is driven primarily (i.e.: >50%) for employment purposes and the kilometres for personal use are not more than 1,667 per 30-day period, or a total of 20,004 kilometres per year.

Therefore, the reduced standby charge for an employer-provided automobile that was available to an employee throughout the entire year is calculated as follows:

The personal use of an employer-provided automobile may also result in an operating expense benefit to the extent that the employer pays all of the automobile operating expenses (i.e.: insurance, maintenance, and fuel). The operating expense benefit is calculated as the number of personal use kilometres multiplied by the government prescribed annual rate per kilometre. The operating expense benefit is reduced for any employee expense reimbursements made within 45 days of the end of the year (i.e.: by February 15, 2021).

The prescribed rate per kilometre for most employees is 28 cents for 2020 and has been reduced to 27 cents for 2021.

Finally, if an employee’s use of the automobile is primarily (i.e.: >50%) for employment purposes, the employee may elect to have the operating expense benefit calculated as 50% of the standby charge, if this would result in a lower taxable benefit. The employee is required to notify the employer of their election to have the operating expense benefit calculated in this manner.

During 2020, the COVID-19 pandemic resulted in business lockdowns and reduced business activity, which may have resulted in employment automobile mileage being reduced compared to a normal year. Therefore, if an employee has used the employer-provided automobile less for employment purposes, they may no longer qualify for the reduced standby charge for tax purposes, even if their personal driving use may be similar to prior years.

Accordingly, on December 21, 2020 the Federal Government proposed draft legislation to allow an employee to use their 2019 automobile usage to determine whether they use the automobile primarily for employment purposes in order to access the reduced standby charge for both 2020 and 2021. However, the employee’s standby charge would still be calculated using the employee’s personal kilometres driven for 2020 or 2021 respectively.

For example, consider the situation where an employee drove 12,000 kilometres for employment purposes and 8,000 kilometres for personal purposes in 2019. Then, in 2020, the employee drove 5,000 kilometres for employment purposes and 7,000 kilometres for personal purposes. Although the 2020 employment usage is only 41.67% (5,000/12,000), the employee would still be able to calculate the reduced standby charge for 2020 because the employment usage in 2019 was 60% (i.e.: 12,000/20,000). The employee’s standby charge for 2020 would still be calculated using the employee’s personal kilometres driven in 2020 (i.e.: the regular standby charge would be adjusted by the factor 7,000/20,004).

The same change would apply in respect of the option to calculate the operating expense benefit as 50% of the standby charge. Therefore, eligibility to calculate the operating expense benefit as 50% of the standby charge would be based on the employee using the automobile primarily (>50%) for employment purposes in 2019. In addition, it is proposed that for 2020 and 2021, employees would not have to notify their employer of the optional calculation of the operating expense benefit. Rather, an employee’s operating expense benefit would be automatically calculated as the lesser of either the operating expense benefit determined using the per-kilometre prescribed rate or the optional calculation.

Note that these changes to determining the 2020/2021 reduced standby charge and optional operating expense benefit calculation would only be available to employees with an automobile provided by the same employer as in 2019.

For more details on the proposed temporary adjustments to the automobile standby charge for 2020 and 2021, please refer to the December 21, 2020 Department of Finance Backgrounder.

Form PD27 - 10% Temporary Wage Subsidy Self-Identification Form for Employers

The 10% Temporary Wage Subsidy (TWS) was a three-month measure that allowed eligible employers to reduce the amount of payroll income tax withholdings to be remitted to CRA. The subsidy was equal to 10% (or a lower percentage that the employer elected to claim) on the remuneration from March 18 to June 19, 2020. There was a maximum of $1,375 for each eligible employee and an overriding limit of $25,000 for each employer.

Subsequent to the eligibility period for the TWS, CRA released Form PD27 – 10% Temporary Wage Subsidy Self-identification Form for Employers. This form must be completed by all employers who are eligible to take advantage of the TWS and:

Already reduced remittances;

Intend to reduce remittances (the form will assist in calculating the eligible TWS amount); or

Claimed the Canada Emergency Wage Subsidy (CEWS) and, as a result, need to confirm on Form PD27 the amount of the TWS claimed (refer to Line F of the CEWS application).

Note that an employer should also state how they want to apply any unpaid balances of the TWS on their Form PD27 in the “Additional Comments” section.

In addition, an eligible employer with more than one payroll program (RP) account must complete and submit separate self-identification forms for each account.

Finally, the Form PD27 must be completed regardless of whether the TWS has been claimed, unless the eligible employer has elected not to participate in both the CEWS and TWS. If the employer has applied for the CEWS and does not want to also participate in TWS, a special election can be made for the TWS to be equal to 0% of the remuneration paid. To make the election, the employer must enter March 18 to June 19, 2020 as the pay period on the Form PD27 and enter “0” in Part D for the dollar amount and percentage of the subsidy claimed. If “0” is not entered in Part D, the employer will be considered to have taken advantage of the full 10% TWS and the CEWS claim may be reduced and recovered if necessary.

CRA will use the information from the PD27 form to reconcile the subsidy for the payroll program (RP) accounts. If the TWS has been claimed, but it is determined that the employer was not eligible or the TWS claimed exceeded the allowable amount, the CRA will assess this amount as payable. This assessment may include penalties and interest.

The completed Form PD27 can be submitted online through “My Business Account” using the Submit Documents option. Alternatively, it can be mailed or faxed to a National Verification and Collections Centre (NVCC). The closest NVCC for residents of the Greater Toronto Area is:

Shawinigan NVCC

4695 Shawinigan-Sud Boulevard

Shawinigan-Sud QC G9P 5H0

Fax number: 819-536-5031

For more details on reporting the TWS to CRA, please visit the following CRA website.

For further guidance on the impact of COVID-19 on your payroll reporting issues, please contact your Shimmerman Penn advisor.