On July 17, 2020, the Department of Finance announced proposed legislation with respect to the Canada Emergency Wage Subsidy (CEWS) Program. This legislation has received royal assent as of July 27, 2020. These changes apply beginning with Claim Period 5, the four weeks from July 5, 2020 through August 1, 2020.

The most significant changes to the CEWS Program include the following:

CEWS applications can be made until January 31, 2021 (previously September 30, 2020);

CEWS periods have been extended up to the period ending November 21, 2020 (may be further extended to a period that ends no later than December 31, 2020);

Employers with any reduction in revenue will be eligible to a claim proportionate to revenue loss (replaces the 30% all or nothing threshold);

Introduction of a new “two-part” CEWS with respect to the remuneration of active employees;

Separate CEWS rate structure for furloughed employees; and

Amendments to the determination of the basis for eligible remuneration, eligible employees and revenue decline criteria.

Two-Part CEWS for Active Employees

Effective July 5, 2020 (i.e.: Period 5 and subsequent periods), the CEWS will consist of two parts:

Base subsidy available to all eligible employers that are experiencing any amount of decline in revenues. This base subsidy amount will vary depending on the level of revenue decline; and

Top-up subsidy to a maximum of 25% of eligible remuneration for eligible employers that have had a revenue decline greater than 50% in the preceding 3 months as compared to the relevant reference period.

The total subsidy that an employer may receive per employee will be capped at a fixed amount, which will change over the periods. The amended program details are provided for the periods beginning July 5, 2020 to November 21, 2020.

In addition, the current CEWS rate of 75% will be “grandfathered” for periods beginning July 5, 2020 and August 2, 2020 (i.e.: Period 5 and Period 6). Therefore, for these periods, employers can continue to be eligible for a minimum CEWS rate of 75%, provided they have experienced a revenue decline of 30% or more as compared to the relevant reference period.

Base Subsidy Calculation

Effective July 5, 2020, the base CEWS amount for active employees will be based on a specified rate, applied to the amount of remuneration paid to the employee for the eligibility period, on eligible remuneration of up to $1,129 per week. This rate will vary depending on the level of revenue decline.

Accordingly, the CEWS may extend to employers with a revenue decline of less than 30% for the relevant month. Furthermore, the maximum base CEWS rate will apply to employers with a decline in revenue of 50% or more for the relevant month. The base CEWS rates are gradually reduced over the subsequent periods.

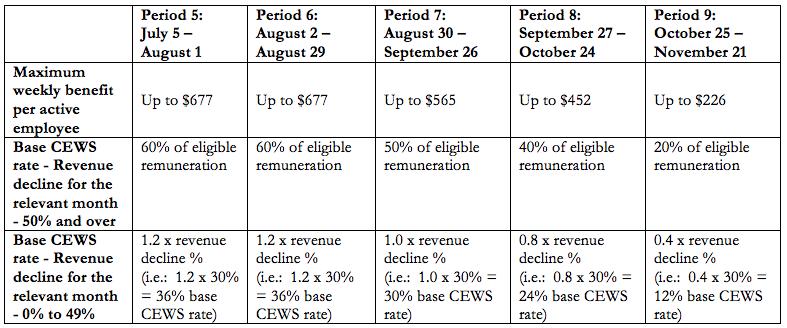

The following Table 1 summarizes the rate structure for the base CEWS for periods beginning July 5, 2020:

Table 1:

Top-Up Subsidy Calculation

A top-up CEWS rate of up to 25% will be available to employers that have been more negatively impacted by the COVID-19 pandemic. Generally, an eligible employer’s top-up CEWS rate will be determined based on the revenue decline experienced in the preceding three months. This decline will be compared to a selected prior reference period in the following manner:

the average monthly revenue in the preceding three months as compared to the average monthly revenue for the same three months in the prior year; or

the average monthly revenue in the preceding three months as compared to the average monthly revenue for January and February 2020.

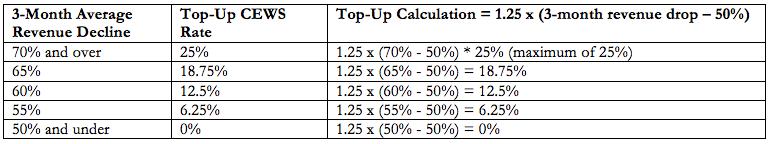

Employers that have experienced a 3-month average revenue decline of more than 50% will receive a top-up CEWS rate equal to 1.25 times the average revenue decline in excess of 50%, up to a maximum top-up CEWS rate of 25%. Therefore, an employer will be eligible for the maximum top-up CEWS rate of 25% if the average revenue in the preceding 3 months has declined by 70% or more as compared to the selected prior reference period. The top-up CEWS rate will also apply to eligible remuneration of up to $1,129 per week.

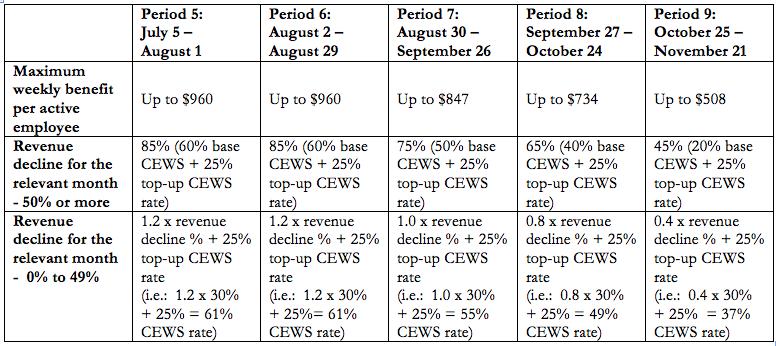

The following Table 2 illustrates the CEWS rate structure for the combined base CEWS and the top-up CEWS for employers that have experienced a 3-month average revenue decline of 70% or more and therefore are eligible for the maximum top-up CEWS rate of 25%:

Table 2:

Note: In Periods 5 and 6, an eligible employer will be entitled to a CEWS rate not lower than the rate that they would be entitled to under the CEWS rules for Periods 1 to 4. Therefore, an eligible employer with a revenue decline of 30% or more in Periods 5 and 6 will receive a total CEWS rate of at least 75%.

As previously noted, the top-up CEWS rate will vary depending on the revenue decline experienced in the preceding three months. The following Table 3 illustrates the top-up CEWS rates for selected average 3-month revenue decline levels:

Table 3:

CEWS for Furloughed Employees:

For Periods 5 and 6, the CEWS calculation for a furloughed employee will be the same as for periods 1 to 4. Therefore, for arm’s length employees, it will be the greater of:

75% of the amount of remuneration paid, up to a maximum benefit of $847 per week; and

The lesser of:

75% of the employee’s baseline weekly remuneration up to a maximum benefit of $847 per week or

The amount of actual remuneration paid

For furloughed non-arm’s length employees, the CEWS will be the lesser of 75% of baseline remuneration and actual eligible remuneration, up to $847 per week.

Beginning in Period 7, CEWS support for furloughed employees will be adjusted to align with the benefits provided through the Canada Emergency Response Benefit (CERB) and/or Employment Insurance (EI). The maximum CEWS amount for these periods is still to be determined.

For Period 5 and subsequent periods, the CEWS for furloughed employees will be available to eligible employers that qualify for either the CEWS base rate or the CEWS top-up rate for active employees in the relevant period.

The employer portion of contributions for the Canada Pension Plan and Employment Insurance in respect of furloughed employees will continue to be refunded to eligible employers for all periods.

Additional CEWS Amendments:

Eligible Remuneration:

No changes have been made to the definition of “eligible remuneration”. Eligible remuneration may include salary, wages, and other taxable benefits. It excludes severance pay, or items such as stock option benefits or the personal use of a corporate-owned vehicle.

Baseline Remuneration

Active Arm’s Length Employees

For Periods 1 to 4, baseline remuneration for arm’s length employees (i.e.: not related) can be based on the average weekly eligible remuneration paid during:

Normal method: January 1, 2020 to March 15, 2020;

Alternative method for Period 1 to Period 3: March 1, 2019 to May 31, 2019; or

Alternative method for Period 4: March 1, 2019 to May 31, 2019, or March 1, 2019 to June 30, 2019.

Employers can choose which period to use on an employee-by-employee basis.

For Period 5 and subsequent periods, eligible remuneration for active arm’s-length employees will be based solely on the actual remuneration paid for the eligibility period (up to a maximum of $1,129 per week), without reference to the baseline remuneration concept used for the earlier CEWS periods as noted above.

Active Non-Arm’s Length Employees

For active non-arm’s length employees (i.e. related), eligible remuneration is based on the employee’s weekly eligible remuneration or baseline remuneration, whichever is less, up to a maximum of $1,129 per week. The subsidy is only be available in respect of non-arm’s length employees employed prior to March16, 2020.

For Periods 1 to 4, the baseline remuneration of a non-arm’s length employee can be based on the same alternative periods as for arm’s length employees as noted above.

For Period 5 and subsequent periods, the baseline remuneration of a non-arm’s length employee will be based on the average weekly remuneration paid from:

January 1 to March 15, 2020; or

July 1, 2019 to December 31, 2019.

As previously stated, employers can choose which period to use on an employee-by-employee basis.

Furthermore, in all cases, the calculation of the average weekly remuneration will continue to exclude any period of 7 or more consecutive days without remuneration.

Eligible Employees

An eligible employee is an individual employed in Canada. Effective July 5, 2020 (i.e. Period 5 and all subsequent periods), the eligibility criteria will no longer exclude employees that are without remuneration in respect of 14 or more consecutive days in the eligibility period.

Qualifying Revenue

Generally, qualifying revenue is gross revenue from ordinary activities of the employer determined under normal accounting practices.

Prescribed organizations that are registered charities or non-profit organizations can now choose whether to include government source revenue in their calculation of qualifying revenue.

Furthermore, there continues to be an election available to choose between the cash or accrual method of accounting. Note, however, that once an election is made, an employer is not permitted to change whether they compute revenue on an accrual basis or a cash basis in a subsequent period. Accordingly, any accrual basis submission or cash basis election is permanent and cannot be changed for Periods 5 through 9.

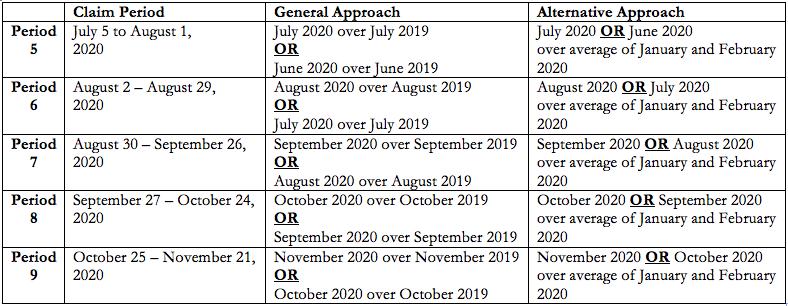

Reference Periods for Revenue Decline Test

Effective July 5, 2020 (i.e.: Period 5 and all subsequent periods), an eligible employer will be able to use the greater of its percentage revenue decline in the current period and that in the previous period for the purpose of determining its qualification for the base CEWS and its base CEWS rate for the current claim period. For example, for Period 5 (July 5, 2020 to August 1, 2020), an eligible employer can use the greater of the percentage revenue decline in July 2020 or June 2020 as compared to the relevant prior reference period.

Employers that have elected to use the alternative approach for the first 4 periods (i.e.: comparison of the relevant calendar month’s qualifying revenue to the average qualifying revenue in January and February 2020) are be able to either maintain that election for Period 5 and subsequent periods or revert to the general approach (i.e.: comparison of the relevant calendar month’s qualifying revenue to the qualifying revenue in the applicable 2019 calendar month).

Similarly, employers that have used the general approach for the first 4 periods are able to continue with the general approach or elect to use the alternative approach for Period 5 and subsequent periods.

Whichever approach is chosen for Period 5 will apply for all subsequent periods and will apply to both the calculation of the base CEWS rate and the top-up CEWS rate.

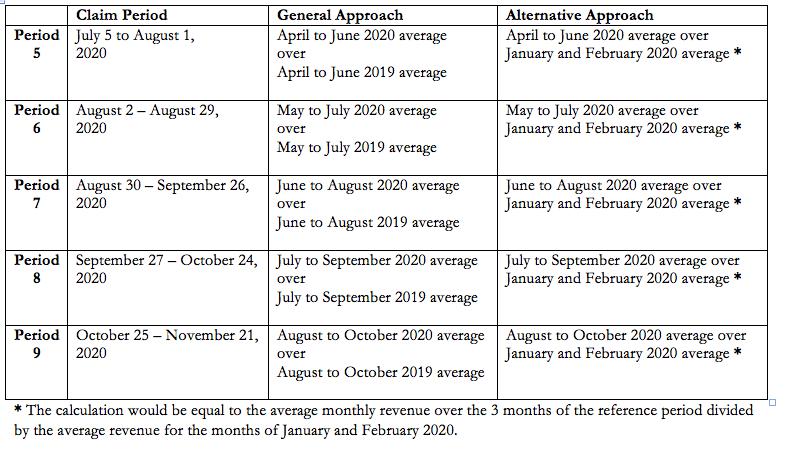

The below Table 4 illustrates the reference periods for the base CEWS for Periods 5 and subsequent periods under the general approach and the alternative approach:

Table 4

For the purpose of the top-up CEWS rate, eligibility would generally be determined by the decline in an eligible employer’s average revenues for the preceding 3-month period. Table 5 below illustrates each claiming period and the relevant reference period for determining an eligible employer’s average decline in revenue for the preceding 3-month period.

Table 5:

Other Changes

The new CEWS legislation also provides amendments to address additional issues including:

Consequences of corporate amalgamations occurring between reference periods;

Calculation of qualifying revenue during a prior reference period where an employer has purchased all or substantially all of the assets used in carrying on business of a seller;

Allowing certain businesses that use the cash method of accounting as the normal practice (i.e.: self-employed commission agents) to elect to use the accrual method; and

Amending the definition of a “qualifying entity” to include an employer that may not have its own payroll account number because of the use of a “third-party payroll provider”.

Please contact your Shimmerman Penn advisor for further guidance on the impact of the amended legislation with respect to the Canada Emergency Wage Subsidy Program.

Here is the Department of Finance backgrounder released at the time the amendments were announced.

Canada Revenue Agency has published a FAQ regarding CEWS, but it has not been updated to reflect these changes. We expect it will be revised before claims for period 5 are eligible to be submitted (beginning August 2).