In this ever-changing environment of COVID-19, the Canada Revenue Agency has recently announced new extensions for personal and corporate tax return filings, to provide relief to taxpayers.

Personal

The deadline for most individuals to file their 2019 personal tax return was previously extended to June 1, 2020. The deadline for self-employed individuals and their spouse or common-law partner to file their tax returns is June 15, 2020. The deadline to pay amounts owed for 2019 had also been extended to September 1, 2020, for all individuals.

The CRA has now announced that they will not assess penalties and interest if payments are made and the tax return is filed by September 1st. This personal waiver includes T1135 (foreign asset holdings) returns and any elections, forms or schedules required to be filed with the return, provided they are filed by September 1.

In addition, if you pay your personal tax by instalments, the June 15th payment due date was extended to September 1st.

Corporations

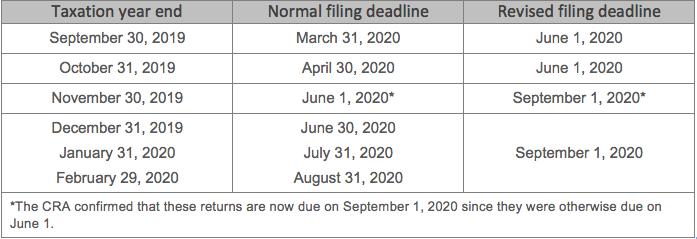

The CRA has announced that the filing deadline for Corporate T2 income tax returns that would have otherwise been due in June, July or August 2020 is now extended to September 1st.

This chart summarizes the impact of these extensions:

The corporate extension waiver includes T1135 (foreign asset holdings), T106 (transactions with non-arm’s length non-residents) returns, and any other elections, forms or schedules required to be filed with the return.

As previously announced, any income tax balance due on or after March 18 and before September 1 will also be due by September 1, 2020.

For further details, please see the CRA's release regarding personal filing, and regarding corporation filings.

To discuss your particular situation, please contact your usual FTSP colleague.