Since March 2020, the federal government has implemented several support measures to assist businesses that have been negatively impacted by the COVID-19 pandemic. In our November 24, 2021 SPARK article, we provided an overview of the current rules and upcoming deadlines for the existing subsidy programs as well a description of the new subsidy programs that had been proposed by the Department of Finance to support certain businesses that continue to be negatively impacted by the COVID-19 pandemic.

The new subsidy programs proposed by the Department of Finance include the Tourism and Hospitality Recovery Program (“THRP”) and the Hardest-Hit Business Recovery Program (“HHBRP”). In addition, a separate “Local Lockdown Program” subsidy was proposed which would allow businesses that face temporary local lockdowns due to the COVID-19 pandemic to qualify for the THRP subsidy, even if they do not operate in the tourism and hospitality sector.

On December 17, 2021, Bill C-2, which provided the legislation to implement these new subsidy programs, as well as extend access to the Canada Recovery Hiring Program (“CRHP”), received Royal Assent. Accordingly, these program subsidies are now available to qualifying organizations beginning October 24, 2021 to May 7, 2022 (Periods 22 to Period 28). The legislation also provides the ability to prescribe by regulation further qualifying periods for these subsidies, ending no later than July 2, 2022.

In this article, we will provide some additional details with respect to the new business subsidies that have been confirmed by the enacted legislation, as well as links to the new CRA calculators/attestation forms and important filing deadline information. Finally, we will provide an update on the recently announced repayment deadline extension for the Canada Emergency Business Account (“CEBA”).

The Tourism and Hospitality Recovery Program (“THRP”) – Clarification of a “Qualifying Tourism or Hospitality Entity”

Bill C-2 provided the legislation to continue the wage and rent/property expense subsidies for eligible entities in selected sectors of the tourism and hospitality industry. Bill C-2 also provided additional details with respect to the definition of a “qualifying tourism or hospitality entity” which may be eligible for the THRP.

Specifically, in addition to having a current-month revenue decline in the period of at least 40% and an average monthly revenue decline of at least 40% over the first 13 qualifying periods for CEWS (“12-month revenue decline”), the entity’s qualifying revenue in these periods must have been earned primarily (i.e. more than 50%) from carrying on one or more tourism or hospitality-related activities (including but not limited to):

-

Hotels, resorts, cottages and other traveler accommodation;

-

Restaurants and bars;

-

Travel arrangement and reservation services;

-

Performing arts companies;

-

Festivals;

-

Fitness and recreational sports centres;

-

Casinos;

-

Banquet/event halls;

-

Convention and trade show organizers.

Please note that the Department of Finance has specifically excluded golf and country clubs from the list of qualifying entities.

The 12- month revenue decline is calculated as the average of all revenue decline percentages for the eligible organization from March 2020 to February 2021 (i.e.: CEWS Periods 1 to 13, and excluding either Period 10 or Period 11). Any periods for which an organization was not carrying on its ordinary operations for reasons other than a public health restriction (i.e. seasonal business that does not operate during certain months) is excluded from the calculations.

Please visit the CRA website for detailed information on the THRP as well as a more complete list of eligible tourism or hospitality activities.

Proposed Expansion to Eligibility for the Local Lockdown Program (Qualifying Public Health Restriction)

Bill C-2 also included a new Local Lockdown Program, which permits an organization that is subject to a “qualifying public health restriction” to be eligible for wage and rent/property expense support at the subsidy rates as calculated for the THRP, regardless of the sector in which they operate.

In order to be eligible for this subsidy, the organization has to have one or more locations subject to a “public health restriction” lasting for at least seven days in the current claim period and that requires them to cease activities that accounted for approximately 25% of total revenues of the organization during the prior reference period. In addition, in this situation, the organization would not need to demonstrate the average 12-month revenue decline, but rather only a current-month revenue decline of at least 40%.

On December 22, 2021, the government announced new proposed regulatory changes to temporarily expand eligibility for the wage and rent/property expense support for organizations under the Local Lockdown Program. These changes would:

-

Allow entities to qualify if they are subject to a capacity-limiting public health restriction of 50% or more; and

-

Reduce the current-month revenue decline threshold requirement from 40% to 25% for these entities.

This temporary expansion of the Local Lockdown Program currently only applies to claim Periods 24 to 26 (December 19, 2021 to March 12, 2022).

Please note that when completing the CRA wage or rent/property expense subsidy calculator (discussed below), it will identify an entity eligible for the Local Lockdown Program as eligible for the THRP.

Please visit the CRA website for more detailed information on the Local Lockdown Program.

The Hardest-Hit Business Recovery Program (“HHBRP”)

Bill C-2 provided the legislation to also continue the wage and rent/property expense subsidies for organizations that do not qualify for the THRP or the Local Lockdown Program, but that have been and continue to be significantly impacted by the COVID-19 pandemic.

In order to qualify for the HHBRP, an eligible organization must have a current-month revenue decline of at least 50% and an average monthly revenue decline of at least 50% over the first 13 qualifying periods for the CEWS (“12-month revenue decline”).

As with the THRP, the 12- month revenue decline is calculated as the average of all revenue decline percentages for the eligible organization from March 2020 to February 2021 (i.e.: CEWS Periods 1 to 13, and excluding either Period 10 or Period 11). Any periods for which an organization was not carrying on its ordinary operations for reasons other than a public health restriction (i.e. seasonal business that does not operate during certain months) is excluded from the calculations.

Please visit the CRA website for more detailed information on the HHBRP.

Canada Recovery Hiring Program (“CRHP”)

Finally, entities that do not qualify for either the TRHP, Local Lockdown Program or HHBRP may still be eligible for the CRHP if they have experienced a current-month revenue decline of greater than 10% and have had an increase in eligible remuneration in the period as compared to the base period of March 14, 2021 to April 10, 2021 (i.e.: CEWS Period 14).

The subsidy is calculated as up to 50% of this incremental increase in eligible remuneration paid to eligible employees in respect of the relevant period.

Please visit the CRA website for more detailed information on the CRHP.

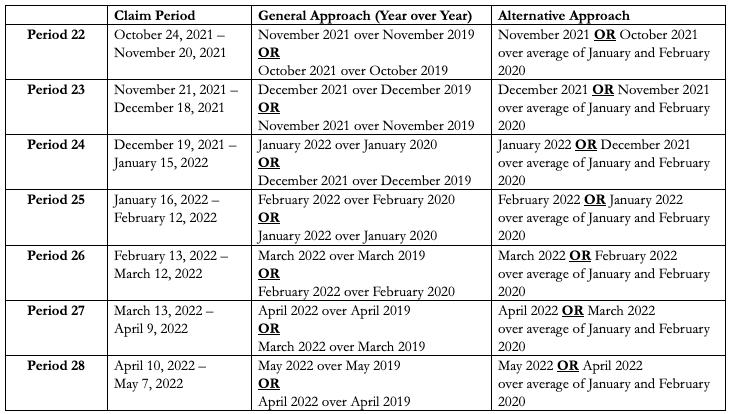

Revenue Decline Reference Periods until May 7, 2022

The following table outlines the qualifying periods and the relevant prior reference periods for determining a change in revenue for the CRHP, THRP/Local Lockdown Program and HHBRP from October 24 2021 to May 7, 2022:

New CRA Calculators and Attestation Forms

CRA has released new online calculators to assist organizations to determine eligibility to the CRHP, THRP/Local Lockdown Program or HHBRP.

The calculator for the CRHP and wage subsidy portion of the THRP/Local Lockdown Program or HHBRP can be found on the CRA COVID-19 wage and hiring support for businesses website. Similar to CEWS, a downloadable calculation spreadsheet as well as an online calculator is available. The calculator guides applicants through a step-by-step calculation to determine eligibility for either the CRHP, THRP or HHBRP. Note that only one type of wage subsidy may be claimed for each eligible period (i.e. – whichever subsidy will result in the higher claim).

As previously discussed, when completing the CRA calculator, it will identify an entity eligible for the Local Lockdown Program as eligible for the THRP.

CRA has also introduced a new attestation form – RC669 Attestation – for entities that are claiming a wage subsidy under the CRHP, THRP/Local Lockdown Program or HHBRP for Periods 22 to Period 28 (October 24, 2021 to May 7, 2022). Similar to the CEWS RC661, this attestation must be signed by the individual that has principal responsibility for the financial activities for the entity and retained in the event it is requested by CRA.

For entities that also qualify for the rent/property expense subsidy portion of the THRP/Local Lockdown Program or HHBRP, CRA has updated the online COVID-19 rent and property expense support subsidy calculator to include the new criteria for Periods 22 to Period 28. In addition, a new attestation form – RC664 Attestation – has been introduced for entities that are claiming a rent and property expense subsidy under these new programs. Again, similar to the CERS RC665, this attestation must be signed by the individual that has principal responsibility for the financial activities for the entity and retained in the event it is requested by CRA.

Note also that for entities eligible for the rent and property expense subsidy under the THRP/Local Lockdown Program or HHBRP, the new legislation confirms that the aggregate monthly cap for monthly eligible expenses for all business locations (including any amounts claimed by affiliated entities) has been increased from $300,000 to $1,000,000.

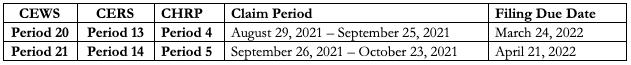

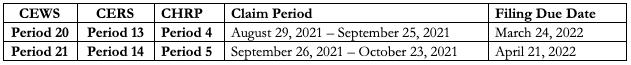

Summary of Upcoming Filing Deadlines:

The following table outlines the remaining CEWS/CERS/CHRP periods that are still open for application and their respective filing deadlines:

The following table outlines the new THRP/HHBRP/CHRP periods and their respective filing deadlines:

CEBA Repayment Extension

The Canada Emergency Business Account (CEBA) program was introduced by the Federal Government to provide interest-free loans of up to $60,000 to eligible businesses and non-profit organizations facing financial hardship as a result of the COVID-19 pandemic. In addition, up to 33% (i.e. $20,000) of the loan was to be forgivable if the balance (i.e. $40,000) was repaid on or before December 31, 2022.

On January 12, 2022, the Department of Finance announced that the repayment deadline for CEBA loans to qualify for this loan forgiveness has been extended from December 31, 2022 to December 31, 2023, for all eligible borrowers in good standing.

Subsequent to December 31, 2023, outstanding loans will convert to two-year term loans with interest of 5% per annum commencing on January 1, 2024, with the loans fully due by December 31, 2025.

For more information, please visit the Government of Canada CEBA website.

Please contact your Shimmerman Penn advisor for further guidance and to discuss your particular situation.