Many of us serve on Boards of Directors of charitable organizations and non-profits. If you're advising or running a charity or not-for-profit organization or volunteering on their Board, you will want to be aware of these financial statements reporting requirements for organizations incorporated under Federal and Ontario legislation.

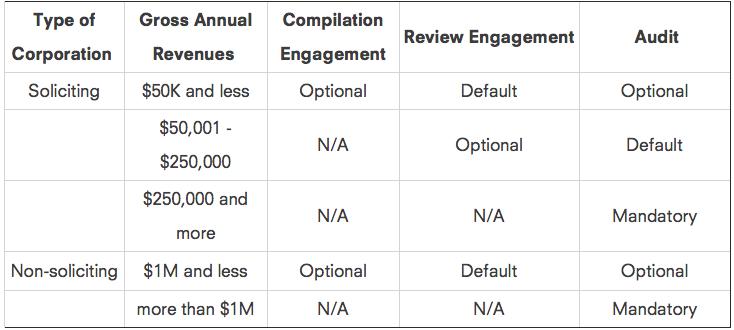

Canada Not-for-profit Corporations Act

For organizations incorporated under the Federal Not-for-profit Corporations Act, the financial statement reporting requirement is based on (1) whether the corporation is soliciting contributions from the public, and (2) the amount of gross annual revenues.

The CRA's page on Requirements for soliciting corporations under the Canada Not-for-profit Corporations Act (NFP Act) is a useful resource for further details.

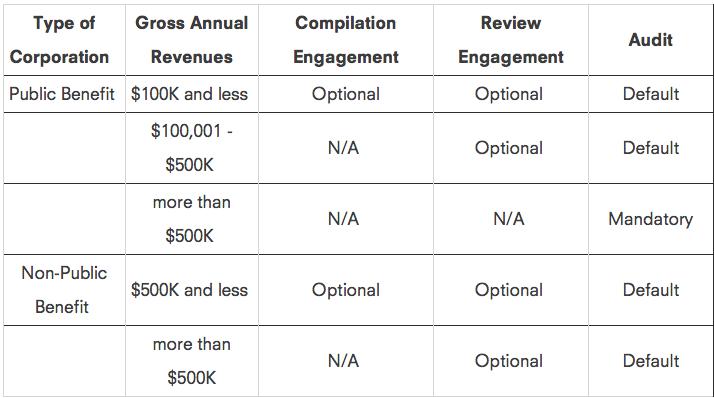

Ontario Not-for-profit Corporations Act

For organizations incorporated under the Ontario Not-for-profit Corporations Act, the financial statement reporting requirement is based on (1) whether the corporation is a public benefit corporation, and (2) the amount of gross annual revenues.

For details on the Ontario Not-for-Profit Corporations Act, follow this link.

As you can see, organizations’ management and Boards of Directors are faced with options regarding annual financial reporting. Our team can also go over the three types of engagements (Compilation, Review Engagement, Audit) review and help you determine which is suitable to meet the legislative requirement and other organizational factors. For a detailed explanation of these 3 types of engagements, please see our previous article on this subject.

Our team of accountants advise on many different aspects of not-for-profit organizations’ operations such as budgeting, financial management, business planning, strategic planning. When you are ready to discuss your not-for-profit's financial statement for this year, contact our team to assist you.