On October 9, 2020, the Department of Finance announced the intention to introduce new, targeted support measures to help businesses and other organizations who continue to experience a decline in revenue as a result of the COVID-19 pandemic.

On November 2, 2020, the Department of Finance announced proposed legislation to implement these measures. This legislation has received royal assent as of November 19, 2020.

As part of these changes, the CEWS program, which was previously extended to November 21, 2020 in July 2020, has now been extended through to June 2021. In addition, the new legislation provides details for how the program will function for periods from September 27, 2020 up to December 19, 2020 (i.e. Periods 8 to 10).

CEWS for Active Employees

Base Subsidy Rate

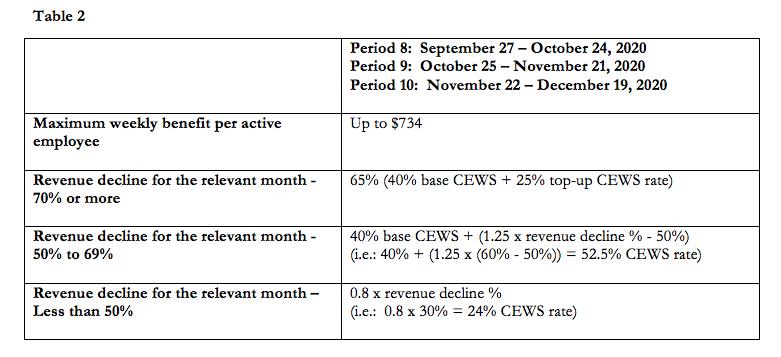

Currently, the base CEWS rate for Period 8 (September 27, 2020 – October 24, 2020) is calculated as 0.8 times the qualifying revenue decline percentage, up to a maximum of 40%.

This base CEWS rate calculation will be maintained for Period 9 (October 25, 2020 – November 21, 2020) and an additional Period 10 (November 22, 2020 – December 19, 2020).

Top-Up Subsidy Rate

The maximum top-up subsidy rate will remain unchanged at 25% for Periods 8 to 10. However, there is a change to the calculation of the eligible top-up subsidy rate for these periods.

Beginning in Period 8, instead of using the current 3-month average revenue decline test to determine the top-up subsidy, both the base and top-up subsidy rates will be determined by the change in an eligible employer’s monthly revenue, for either the current or previous calendar month, compared to the relevant prior reference period (i.e.: 2019 monthly revenue or average of January 2020 and February 2020 revenues).

Note, however, that the new legislation also introduces a “safe harbour” rule applicable to Periods 8 to 10 to ensure that the above change in the revenue decline test does not result in a lower top-up CEWS rate. Accordingly, an eligible employer will still be entitled to a top-up subsidy rate that is not less than it would have received under the three-month revenue decline test, if this results in a more favourable overall subsidy rate.

The applicable top-up subsidy rate will continue to be 1.25 times the qualifying revenue decline in excess of 50%, up to a maximum top-up CEWS rate of 25%.

Therefore, an employer will be eligible for the maximum top-up CEWS rate of 25% if the relevant monthly revenue decline is 70% or more. The maximum total CEWS rate at this level of revenue decline will be 65% (40% base subsidy plus 25% top-up subsidy), and up to $734 per eligible employee per week.

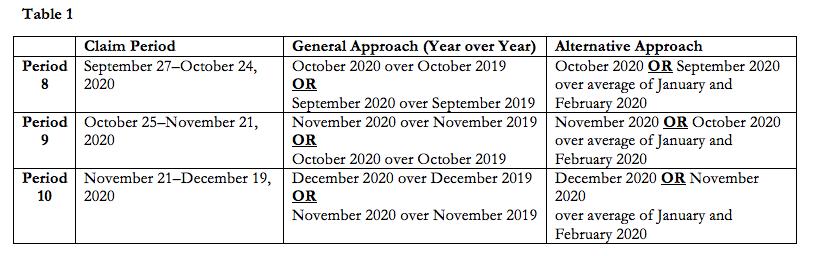

As a reminder, the following table outlines the qualifying periods and the relevant prior reference periods for determining a change in revenue for Periods 8 to 10:

The following table outlines the CEWS rate structure for the combined base CEWS and the top-up CEWS for the periods 8 to 10 beginning September 27, 2020:

CEWS for Furloughed Employees

The original CEWS calculations for furloughed employees were previously extended by the Federal Government to the end of Period 8 (September 27 – October 24, 2020). Under these rules, CEWS for an arm’s length furloughed employee is the greater of:

75% of the amount of remuneration paid, up to a maximum benefit of $847 per week; and

The lesser of:

75% of the employee’s baseline weekly remuneration up to a maximum benefit of $847 per week or

The amount of actual remuneration paid.

For furloughed non-arm’s length employees (i.e.: related), the CEWS is the lesser of 75% of baseline remuneration and actual eligible remuneration, up to $847 per week.

Beginning in Period 9 (October 25 – November 21, 2020), CEWS support for furloughed employees will be aligned with the benefits that would be provided through Employment Insurance. Therefore, the weekly CEWS amount in respect of an arm’s length employee (or a non-arm’s length employee who received baseline remuneration for the relevant period) will be the lessor of:

- The amount of actual remuneration paid in respect of the week; and

- If the employee receives actual remuneration of $500 or more in respect of the week, the greater of:

- $500 and

- 55% of the employee’s weekly baseline remuneration, up to a maximum weekly benefit of $573.

The employer portion of contributions for Employment Insurance (EI), Canada Pension Plan (CPP), and Quebec Pension Plan (QPP) will continue to be refundable.

Additional CEWS Amendments:

Filing deadline

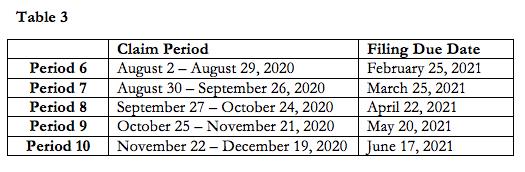

The filing deadline for a CEWS claim for a particular period is now the later of:

January 31, 2021; and

180 days after the end of the specific claim period.

These filing deadlines also apply to amending a previously filed CEWS application.

Accordingly, CEWS claims for Periods 1 to 5 must be filed or amended by January 31, 2021. The due dates for subsequent claim periods are as follows:

Amending or revoking elections

Eligible employers may now amend or revoke any elections, provided the change is made on or before the date that the CEWS application was due for the first qualifying period in respect of which the election is made.

For example, an eligible employer that has elected to use the cash method to determine qualifying revenue may revoke this election and amend the prior period CEWS applications to be based on accrual basis revenue. Note, however, that in this case all claim periods will have to be amended to reflect a change from the cash method to the accrual method, or vice versa.

Similarly, the choice of the prior reference period for the revenue decline test (i.e.: general year-over-year approach or average of January and February 2020) may be changed subsequent to an initial CEWS filing. However, the prior reference period to determine the revenue decline must be consistent for Periods 1 to 4 and then for Periods 5 to 10.

Eligible Employees

The definition of an “eligible employee” has been amended to permit an employee to qualify as long as the employee is employed “primarily” (generally greater than 50%) in Canada throughout the claim period. Note that this amendment is only applicable to CEWS applications filed on or after November 19, 2020 (date of royal assent).

Baseline remuneration

A new optional baseline remuneration period has been added for Periods 5 to 10 for certain circumstances. Specifically, an eligible employer may elect a special baseline remuneration period in respect of an eligible employee returning from a continuous maternity, parental, caregiver, or long-term sick leave that began before July 1, 2019 and ended after March 15, 2020. This baseline remuneration period will be the 90-day period ending immediately before the beginning of the employee’s leave period

For more details on the extension of the Canada Emergency Wage Subsidy, please refer to the November 5, 2020 Department of Finance Backgrounder.

Please contact your Shimmerman Penn advisor for further guidance and to discuss your particular situation.