On April 11th, the Department of Finance issued the eagerly awaited legislation to implement the Canada Emergency Wage Subsidy (CEWS).

As previously announced, the CEWS will provide assistance so that qualified employers who have seen significant drops in revenue can continue to keep employees on payroll, or rehire workers that have been laid off.

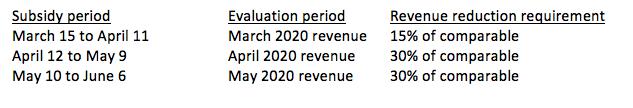

The rules have initially defined three qualifying periods, being March 15 to April 11, April 12 to May 9, and May 10 to June 6. Each qualifying period is 4 weeks long. The legislation provides that additional qualifying periods can be established by regulation until the end of September. Eligibility and subsidy amounts will be calculated for each qualifying period as a separate filing.

Who can make a claim

Eligible entity is defined to include taxable corporations, individuals, registered charities, certain non-profit organizations, and partnerships where every partner is one of the listed entity types. The employer must have been registered for source deductions on March 15, 2020.

Public institutions (municipalities, crown corporations, hospitals, universities etc.) are not eligible to make a claim.

Entities that have seen a significant drop in qualifying revenue will be eligible to make a claim. Calculations for each of the three qualifying periods will be applicable as follows:

The revenue for each of the three months will be compared to a base number. The default base number is the entity’s revenue for the comparable month in 2019.

The entity can elect to use its average revenue for January and February 2020 instead of the 2019 month as its base. Once a comparable has been selected (either 2019 month or Jan/Feb 2020 average), this comparable method must be used for all future periods.

Finally, there is a deeming rule that declares that an entity that meets the revenue test for a particular period is eligible for the subsidy in the next period (even if it would not meet the revenue test in that next period).

Calculation of Revenue

The default rule for computation of revenue is that it should be calculated on an accrual basis for its ordinary activities in Canada, excluding extraordinary items and amounts from non-arm’s length persons or partnerships.

The entity can elect to determine its revenue on a cash basis instead of an accrual basis, with this election applying to all qualifying periods.

There are special rules when an entity is part of an affiliated group.

Either every entity will determine its eligibility based on its own revenue, or every member of the group can jointly elect to determine their eligibility based on the revenue of the group on a consolidated basis.

If more than 90% of the revenue of a particular entity is from non-arm’s length entities, then the eligibility will be determined based on the revenues of the non-arm’s length entities it is supporting (including foreign companies). This may allow captive supply chain or subcontractor employers a claim based on the businesses they are supporting.

There are other special rules particular to charities and not-for-profit organizations.

An entity (or non-arm’s length party) that enters a transaction, takes an action (or fails to take an action) in order to reduce revenue for the purpose of qualifying will be deemed to not qualify for the benefit. Any amounts claimed will be repayable, together with a 25% penalty.

Calculation of Benefit

Benefits will be calculated on an employee-by-employee basis, based on remuneration earned in respect of each week in the period.

An employee’s baseline remuneration is their average weekly earnings from January 1, 2020 through March 15, 2020, for weeks that were worked in the period.

The benefit is not available for an employee who had no remuneration in respect of 14 or more consecutive days in the subsidy period. This exclusion aligns with the individual eligibility for the CERB so that only one subsidy is available for a particular person for each four week period.

For an arm’s length employee the maximum benefit is the least of:

Amount paid in respect of the week

75% of baseline remuneration

$847.

However if the employee had no baseline remuneration (new hire) then the 75% of baseline remuneration is replaced with 75% of actual remuneration.

For a non-arm’s length employee the benefit is the least of:

Amount paid in respect of the week

75% of baseline remuneration

$847.

Effectively, a non-arm’s length employee who was not employed prior to March 15th will not generate a subsidy entitlement.

The benefit is then reduced by any benefit claimed by the employer under the 10% temporary wage subsidy (March 25 legislation), and any amounts received by the employee for the week as a work sharing benefit (Employment Insurance program).

For an employee that is on leave with pay, the benefit will add the employer’s EI premium and the employer’s CPP contribution.

If an employee is employed by two related employers in the same week, the benefit will be limited to the entitlement if all related employers were a single employer.

Applying for the CEWS

CRA plans to have an application through the My Business Account portal, and there will be a web-based application. Neither is currently available.

The individual who has principal responsibility for the financial activities of the entity must “attest that the application is complete and accurate in all material aspects”.

The government intends for payments to be made by direct deposit “shortly after each application”.

Click here to see the full Department of Finance release, and please contact us to consult on your specific circumstances.