Many businesses will need to secure financing at some point. The type of financing you use for your business depends on two key factors: how and when the money will be used.

There are a number of different sources of capital that may be available, such as contributions by the owner(s) and family members, banks and credit unions, private equity partners, and internally generated retained earnings (profit). The type of financing (bank line of credit, bank term loan, mortgage, private loan, owner advances) you choose should be based on what is the most appropriate for your current and projected business needs.

So first, review or set out your business strategy:

- Draft a strategic plan, identifying business cycles and growth opportunities, determining cash required for each component and calculating ROI for each option or business segment.

- Identify owners' liquidity needs and personal resources and factor funding into the strategic plan.

- Revise or reinforce ownership governance structures and agreements to specify owner financing obligations.

- Develop internal policies and procedures for the business sales and purchases cycles to ensure timely billing and collections, proper payment terms for suppliers, and ongoing monitoring and follow up.

- It may also be prudent to build in a "cushion" to avoid unexpected cash shortfalls.

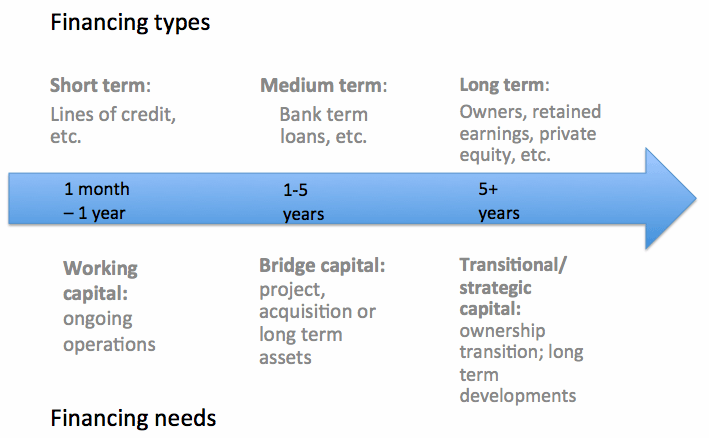

This process should help you to determine how much capital is needed and the types of capital to be matched to each strategy. The sustainability principle indicates that funding and cash flows should be matched with the right kinds of sources. Long term needs should be financed with long term sources and short term need should be financed with short term sources. Cash flow projections are forward looking – ideally they should be updated on a regular and continuous basis, as needs inevitably will change over time.

Some common reasons businesses need financing are:

- Working capital: ongoing operations, including sales, purchases, payroll and cash flow cycles – typically short term financing needs

- Bridge capital: specific projects or acquisition of long lived assets to be used in the business – typically medium term financing needs

- Transitional capital: ownership or strategic transition – a long term financing need

- Strategic capital: long term development of the business – also a long term financing need

Where possible, secure these credit facilities ahead of time, ideally when the business has a healthy balance sheet.

Short-term financing options include: bank operating lines of credit, letters of credit, usually with floating rates, for less than one year, and on a revolving basis.

Medium-term (1-5 yrs) financing options include: bank/institutional term loans, with fixed rates, and generating predictable cash flows

Long term (5+ years) financing options include: owner(s) contributions, accumulated retained earnings, private equity + mezzanine or subordinated lenders; also strategic partners, succession strategy with equity participation.

Owner Advances

The issue of how to structure owner advances is of great interest to our clients. Funds may be contributed by individuals and/or their holding companies. These funds may be generated using personal and corporate lines of credits or other credit facilities which are interest bearing and have other relevant terms and conditions. When structuring owner advances to the business entity, it's important to maintain interest deductibility and plan for sufficient cash flows for the payment of principal and interest.

The ownership agreement for the business entity should contain clauses that address funding terms and the provision of guarantees and security in the event that funds are to be advanced.

Summary

These scenarios are simplistic versions and many businesses require a combination of financing options over their lifetimes. As business advisors we develop a deep knowledge of how best to match specific financing to the business needs, which shift over time.