On October 9, 2020, the Department of Finance announced the intention to introduce new, targeted support measures to help businesses and other organizations who continue to experience a decline in revenue as a result of the COVID-19 pandemic.

On November 2, 2020, the Department of Finance announced proposed legislation to implement these measures. This legislation has received royal assent as of November 19, 2020.

The November 2, 2020 legislation introduced a new business relief program, Canada Emergency Rent Subsidy (CERS), which will provide access to provide direct rent or ownership expenses support for qualifying organizations affected by the COVID-19 pandemic until June 2021.

Eligible Entities

The eligibility criteria for the CERS generally aligns with the Canada Emergency Wage Subsidy (CEWS) program. Therefore, eligible entities may include individuals, corporations, trusts, partnerships, non-profit organizations and registered charities.

In addition, an eligible entity will have to meet one of the following criteria:

Have a payroll account as of March 15, 2020 or have been using a payroll service provider; OR

Have a business number as of September 27, 2020 (in this situation, additional records may have to be provided to CRA to support the rent subsidy claim).

The legislation also states that additional eligibility conditions may be prescribed in the future.

Qualifying Periods

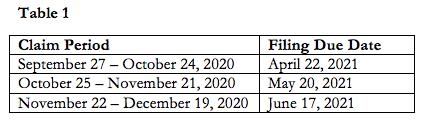

The new legislation provides details for how the program will function for the first three 4-week periods beginning September 27, 2020. These CERS periods and filing due dates, which are aligned with the CEWS program, are as follows:

Eligible Expenses

Eligible expenses are calculated in respect of a qualifying property for the qualifying period. Accordingly, eligible expenses are prorated over each 28 day claim period and not on the full 30 or 31 days in a particular month.

A qualifying property generally includes real or immovable property (i.e. land and buildings) located in Canada, excluding residential property, used by the taxpayer in the course of its ordinary activities.

Commercial Tenants

Eligible expenses for a commercial tenant include the following:

Gross rent;

Rent based on a percentage of sales or similar criterion;

Amounts paid under a “net lease” to the lessor or a third party including:

Base rent;

Regular instalments of operating expenses including property insurance, utilities and common area maintenance expenses, customarily charged to the lessee under a net lease;

Property taxes (including school taxes and municipal taxes).

The following will be excluded from eligible expenses of a commercial tenant:

Sales tax (i.e.: GST/HST) included in the expense;

Amounts paid for damages or due to default under an agreement;

Interest and penalties on unpaid amounts;

Fees paid for special services; and

Common area expense reconciliation adjustment payments.

The qualifying eligible expenses must be reduced by any amounts received from subleasing the property to an arm’s length party (i.e.: unrelated). In addition, payments made between non-arm’s length parties (i.e.: related) do not qualify as eligible expenses.

Commercial Property Owners

Eligible expenses for a commercial property owner include:

Interest on commercial mortgages used to acquire the property (determined within defined limits);

Property taxes (including school taxes and municipal taxes); and

Property insurance.

Eligible expenses of commercial property owners must be reduced by any rental income received or receivable from an arm’s length party (i.e. unrelated).

Note however that no CERS claim will be available where a property used primarily (i.e. generally more than 50%) to earn rental income from an arm’s length party.

For both commercial tenants and property owners, the eligible expenses must have been paid during the qualifying period or will be paid no later than 60 days after the payment of the first CERS amount to which the expenses relate.

In addition, the eligible expenses will be limited to those paid under agreements in writing entered into before October 9, 2020 (or pursuant to a renewal on substantially similar terms).

Finally, the eligible expenses for each qualifying period will be limited to $75,000 per qualifying property and be subject to an overall threshold of $300,000 per qualifying period (i.e.: if an entity has multiple locations).

This overall threshold must be shared among “affiliated persons”. Some examples of “affiliated persons” include (but are not limited to):

An individual and their spouse or common-law partner

Two corporations, if each is controlled by a person, and those two persons are affiliated with each other.

Calculation of the CERS

The CERS is calculated by multiplying the amount of eligible expenses for the qualifying period by the CERS rate. The CERS rate is determined based on the qualifying revenue decline percentage. For applicants who have also filed a CEWS claim, the CERS rate will be equal to the CEWS overall subsidy rate for the claim period.

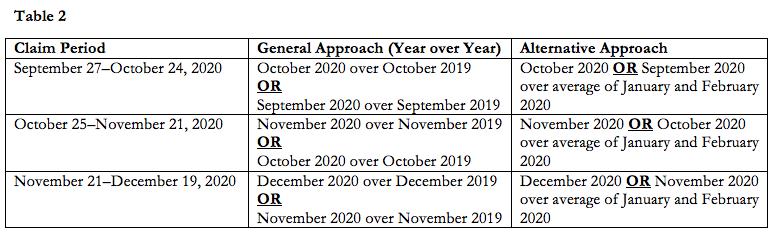

The following table outlines the qualifying periods and the relevant reference periods for determining a change in qualifying revenue:

Note that the revenue decline percentage must also be calculated in the same manner as for the CEWS program. Accordingly, any elections chosen to calculate qualifying revenue and determine the revenue decline percentage for the CEWS program must be the same for the CERS program.

If you have not previously made a CEWS claim, please refer to our April 14, 2020 article for a discussion of the calculation of qualifying revenue.

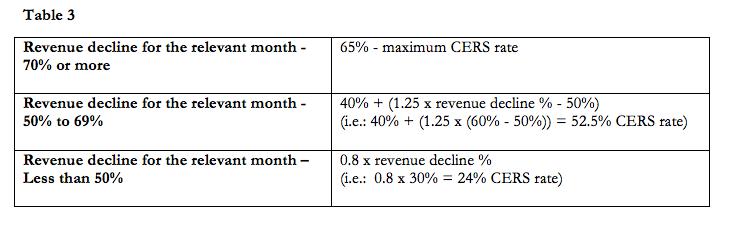

The following table outlines the CERS rate structure for the three qualifying periods beginning September 27, 2020:

For more information, including examples, which illustrate how entities will benefit from the CERS, please refer to the November 5, 2020 Department of Finance Canada Emergency Rent Subsidy Backgrounder.

Please contact your Shimmerman Penn advisor for further guidance and to discuss your particular situation.