Although the ownership structure of the firm will not define how you practice architecture – the structure does play a role in tax planning, compensation and how you transfer value to new owners. Certain ownership structures have advantages over others depending on the situation and the owners' priorities.

The Architects Act, R.S.PO. 1990 is a statute of the Government of Ontario which sets out ownership rules for architecture firms. Articles 14 and 15 specify the requirements for Corporations and Partnerships (respectively) that receive a Certificate of Practice from the OAA.

Article 14 - Corporations

- A corporation may be issued a Certificate of Practice if at least 51% of the voting shares and 51% of the value of all shares of the corporation is directly or indirectly controlled and owned by members of the OAA, or members of the OAA and members of the Professional Engineers of Ontario (PEO)

- Indirect ownership means that any shareholder of a corporation that holds a Certificate of Practice may hold their shares through a Holding Company

- A majority of the directors of the corporation holding a Certificate of Practice must be comprised of members of the OAA, the PEO or both the OAA and PEO

Article 15 - Partnerships

- A general partnership may be issued a Certificate of Practice if at least 51% of the voting interests and 51% of the financial interests in the partnership is directly or indirectly held by members of the OAA, members of the PEO, or members of the OAA and PEO

- Voting interest: where a vote is taken by the partners, the percentage of that vote which is held by members

- Financial interest: the monetary value of the ownership units of the partnership that is held by members

- Indirect ownership: any partner of a partnership that holds a Certificate of Practice may hold their partnership interest using a Holding Company

Advantages of a Corporation ownership structure

The corporation ownership structure along with the additional holding companies and family trusts provides 3 main financial and tax advantages as follows:

- Potential tax deferral

- Trusts can fund dependants' education and income splitting

- Enhance a succession plan

Before we can look at specific details and examples of different corporate structures, we'll need a quick tax refresher so you can better understand the concepts and the relationship between personal and corporate taxes.

Relationship of personal and corporate taxes

Where an individual earns business income and pays tax on the earned income, the after-tax amount belongs to the individual for personal use. However, where a corporation earns business income and pays tax on the earned income, the after-tax amount in the corporation belongs to the corporation.

Only the corporation has use of the after-tax funds. For the individual shareholder to gain access to the after-tax corporate funds, the corporation would pay out a taxable dividend to the individual shareholder, which will give rise to additional taxes payable by the individual shareholder. Therefore, income earned by a corporation is actually taxed twice – first when earned by the corporation; and second when distributed to the shareholder. This is the two-step tax system that is in place in Canada for corporate income.

Dividends paid by a corporation to another corporation that is a significant shareholder can possibly be received tax free, based on specific rules regarding ownership. Dividend distributions to individual shareholders are taxed at special rates which are lower than the personal tax rates on business income. The reason for these reduced rates is to account for the corporate taxes that have already been paid on the income by the corporation. One might assume that two taxes are worse than one. That is, that paying both corporate and personal tax would be higher than paying just personal tax if the business income was earned personally without the corporate vehicle.

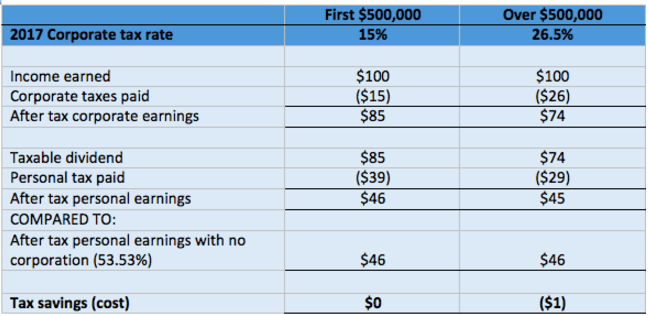

However, the income tax system is designed to avoid this scenario. We've provided an example to demonstrate how taxes are paid. These numbers have been rounded for simplification of illustration, and we are using the example of $100. Note that in Canada, there are two corporate tax rates – the first $500,000 is taxed at 15% and everything above that is taxed at 26.5% (Ontario). In addition, we are assuming the highest marginal personal tax rate.

Let's start with the left column which is based on the small business rate of 15% and see how the numbers work out. Based on earnings of $100, the corporation pays $15 in tax and is left with $85 to distribute after tax to the individual shareholder. Once distributed to the shareholder, this $85 is then subject to additional personal tax on the dividend, the end result is $46 of income left after both corporate and individual taxes have been paid.

Let's now compare this to the amount left over if the income was earned personally and assuming the top personal marginal tax rate, the same $100 will attract $54 of tax and the individual is left with $46 after tax. You can see that there is no difference in tax when the income is earned through the corporation vs. the same amount earned personally.

Let's now look at the right column where the corporation pays tax at the higher rate of 26.5% (rounded to 26% for illustrative purposes). Taking the same $100 amount, the corporation will have $74 after tax for distribution and after distributing it through dividends the individual shareholder is left with $45. As you can see, there is a $1 cost in this scenario.

This tax cost was traditionally much higher in previous years due to higher tax rates in Ontario, which is why it was a common strategy for companies to pay bonuses to the owner-managers to reduce the corporation's taxable income to the small business limit. Retaining income in the corporation that is taxed at the general rate is becoming more common.

Now that we've reviewed the tax concepts of personal and corporate taxes, let's go back to the three advantages of having a corporate structure, the first being tax deferral.

Tax Deferral

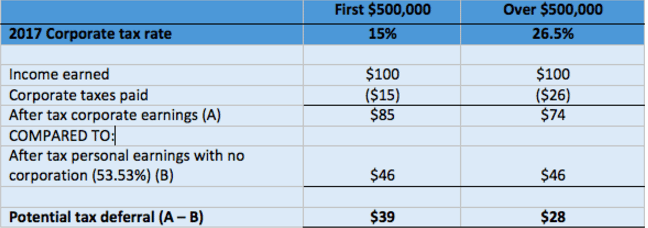

When income is earned it is taxable to the entity that earns it in the year that it is earned. This means that when an individual earns business income personally in a year, they have no option but to pay tax on the earned income at 53.53% (assuming at the highest tax rate in Ontario). Where a corporation earns business income in a year, it pays tax on the earned income at 15% or 26.5%. However, the shareholder of the corporation does not pay the second level of tax on the corporate earned income until they withdraw funds from the corporation in the form of a taxable dividend. If the funds are not withdrawn, the second level of tax can be deferred until the time when the dividend is actually paid or declared to the individual shareholder. See the chart below for a numerical illustration of this concept.

This deferral of the second level of tax, or the personal element of the tax, can potentially be indefinite. Where the personal tax is deferred long enough, the advantages realized by re-investing the corporate after-tax funds can outweigh the tax cost associated with paying a higher corporate tax rate. A tax deferral is just that, the deferral of the payment of tax. Eventually, the personal tax portion on the dividend distribution will be payable, it is just a matter of how long the deferral will be maintained.

By retaining corporate funds taxed at the small business rate in the corporation, 70% of the tax is deferred. By retaining corporate funds taxed at the general rate in the corporation, 50% of the tax is deferred.

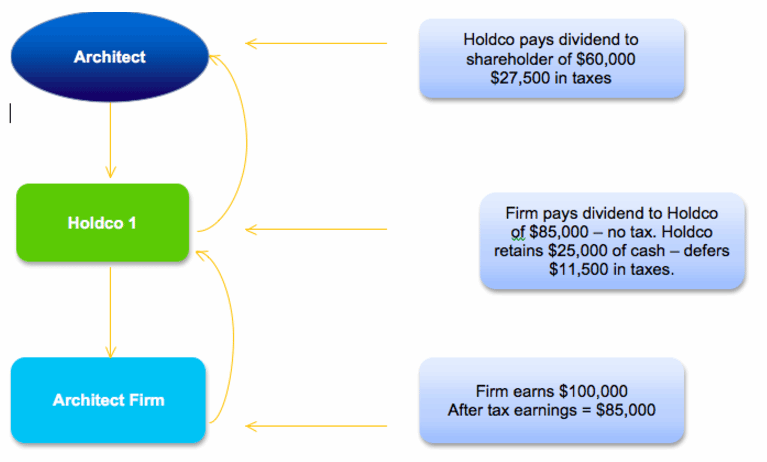

The diagram below illustrates the flow of funds and the tax deferral concept:

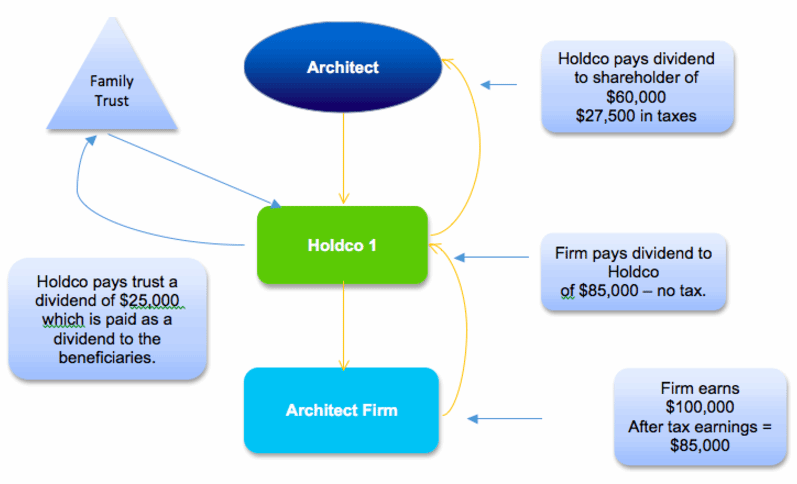

Income Splitting with Family Members

The second advantage of using a corporation is the potential opportunity for income splitting with family members in lower personal tax brackets through the use of family trusts. In this scenario, the shareholders of the holding company are the architect and the family trust. The beneficiaries of the family trust are the architect's spouse and children. With the use of the family trust, the beneficiaries can be paid dividends which will be taxed in their hands. For example, if the spouse has no income, they can receive dividends up to $39,000 without incurring any personal tax. The same is true for any children aged 18 and over. The dividend received by the children can go towards their university tuition. In this scenario not only have we deferred the tax but we have also eliminated the tax altogether (potential tax savings of $11,500). See the illustration below. The Federal Government announced in its 2017 budget that it plans to review the tax rules regarding the allocation of income to family members. Tax planning opportunities may change, and we will be monitoring this area for our clients.

Enhance an Internal Succession Plan

One of the biggest hurdles in any succession plan is the financing requirements of buyers as many new buyers already have other financial responsibilities (i.e. mortgages, school etc.). The corporate structure is one method that can enable new buyers to purchase their shares in a more tax efficient manner which is the third advantage of the corporate structure. If structured properly, it may be possible to use after-corporate tax dollars to fund a portion of the purchase. There are many income tax factors to consider when structuring this type of transaction and professional advice should be sought.