Impending Canada Emergency Wage Subsidy (CEWS) filing deadlines

CEWS claims for Periods 1 to 5 (March 15, 2020 to August 1, 2020) must be filed or amended by January 31, 2021.

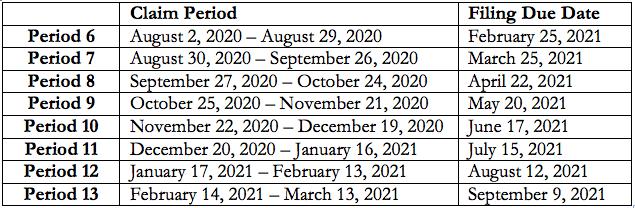

The due dates for subsequent CEWS claim periods* will be 180 days after the end of the specific claim period as follows:

*Note: The above filing deadlines also apply to amending a previously filed CEWS application.

Canada Emergency Wage Subsidy and Canada Emergency Rent Subsidy Update

On November 30, 2020, the Minister of Finance and Deputy Prime Minister Chrystia Freeland delivered the 2020 Fall Economic Statement. In this statement, the Federal Government announced the proposed details with respect to the extension of the Canada Emergency Wage Subsidy, the Canada Emergency Rent Subsidy and the Lockdown Support programs for the periods beginning December 20, 2020 to March 13, 2021.

Canada Emergency Wage Subsidy (CEWS)

On December 18, 2020, the Department of Finance announced that the government had concluded the necessary regulatory changes to raise the maximum wage subsidy rate to 75% for periods beginning December 20, 2020 to March 13, 2021 (i.e.: Periods 11 to 13). The following details were provided with respect to the changes to the CEWS program for periods.

CEWS for Active Employees

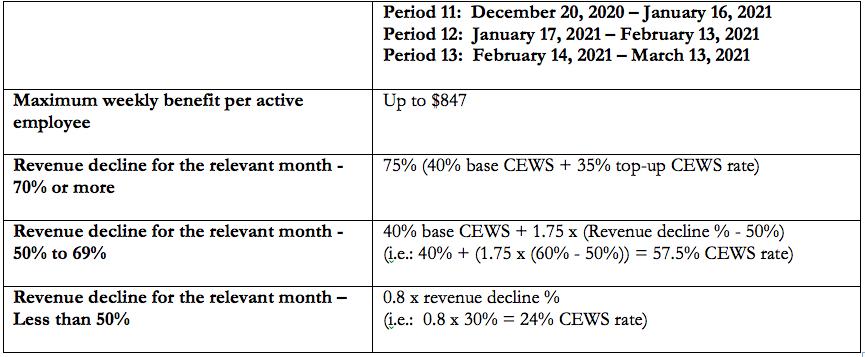

Currently, the base CEWS rate (i.e.: Periods 8 to 10) is calculated as 0.8 times the qualifying revenue decline percentage, up to a maximum of 50% revenue decline (40% subsidy). This base CEWS rate calculation will be maintained for Periods 11 to 13 (December 20, 2020 – March 13, 2021).

The maximum top-up subsidy rate for Periods 11 to 13 has been increased from 25% to 35%. An employer will be eligible for the maximum top-up CEWS rate of 35% if the relevant monthly revenue decline is 70% or more. Accordingly, the maximum total CEWS rate at this level of revenue decline will be 75% (40% base subsidy plus 35% top-up subsidy), and up to $847 per eligible employee per week.

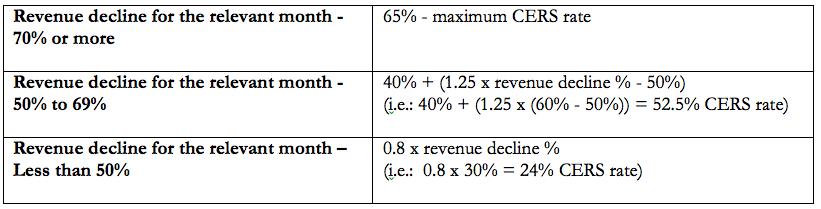

The following table outlines the CEWS rate structure for the combined base CEWS and the top-up CEWS for the Periods 11 to 13 beginning December 20, 2020:

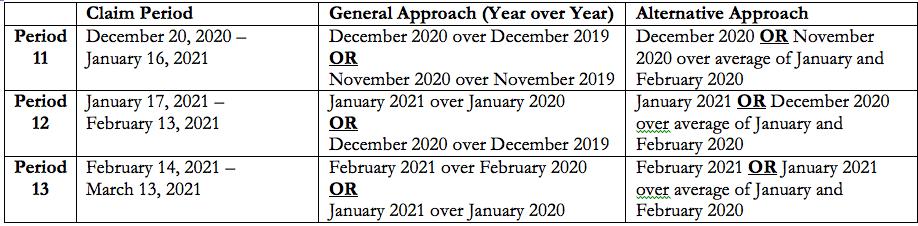

As was announced in the November 2, 2020 legislation, both the base and top-up CEWS rates are determined based on the change in an eligible employer’s monthly revenue for either the current or the previous calendar month, compared to the relevant prior reference period.

The following table outlines the qualifying periods and the relevant prior reference periods for determining a change in revenue for Periods 11 to 13:

Please note that the revenue comparison months for Period 11 are the same as for Period 10.

CEWS for Furloughed Employees

Beginning in Period 11 (December 20, 2020 – January 16, 2021), the maximum potential weekly CEWS support for furloughed employees has been increased from $573 to $595. Therefore, the weekly CEWS amount in respect of an arm’s length employee (or a non-arm’s length employee who received baseline remuneration for the relevant period) will be the lessor of:

The amount of actual remuneration paid in respect of the week; and

The greater of:

$500 and

55% of the employee’s weekly baseline remuneration, up to a maximum weekly benefit of $595.

The employer portion of contributions for Employment Insurance (EI), Canada Pension Plan (CPP), and Quebec Pension Plan (QPP) will continue to be refundable for furloughed employees.

Canada Emergency Rent Subsidy (CERS) and Lockdown Support

On December 18, 2020, the government also concluded the necessary regulatory changes to extend the CERS and Lockdown Support programs for three additional periods from December 20, 2020 to March 13, 2021.

Qualifying Periods

The existing and additional CERS periods and filing due dates, which are aligned with the CEWS program, are as follows:

Calculation of the CERS and Lockdown Support

No changes were introduced to the current calculation method and current rate structure of the CERS.

The following table outlines the base CERS rate structure for the six qualifying periods beginning September 27, 2020:

In addition, no changes were introduced to the calculation method for the top-up CERS subsidy or “Lockdown Support”. Accordingly, the Lockdown Support continues to be equal to 25% of expenses eligible for CERS for entities that must shutdown a location or significantly limit their activities because of a “public health restriction”.

Please see our November 2, 2020 SPARK articles for a more detailed explanation of the CERS and Lockdown Support programs.

Please contact your Shimmerman Penn advisor for further guidance and to discuss your particular situation.